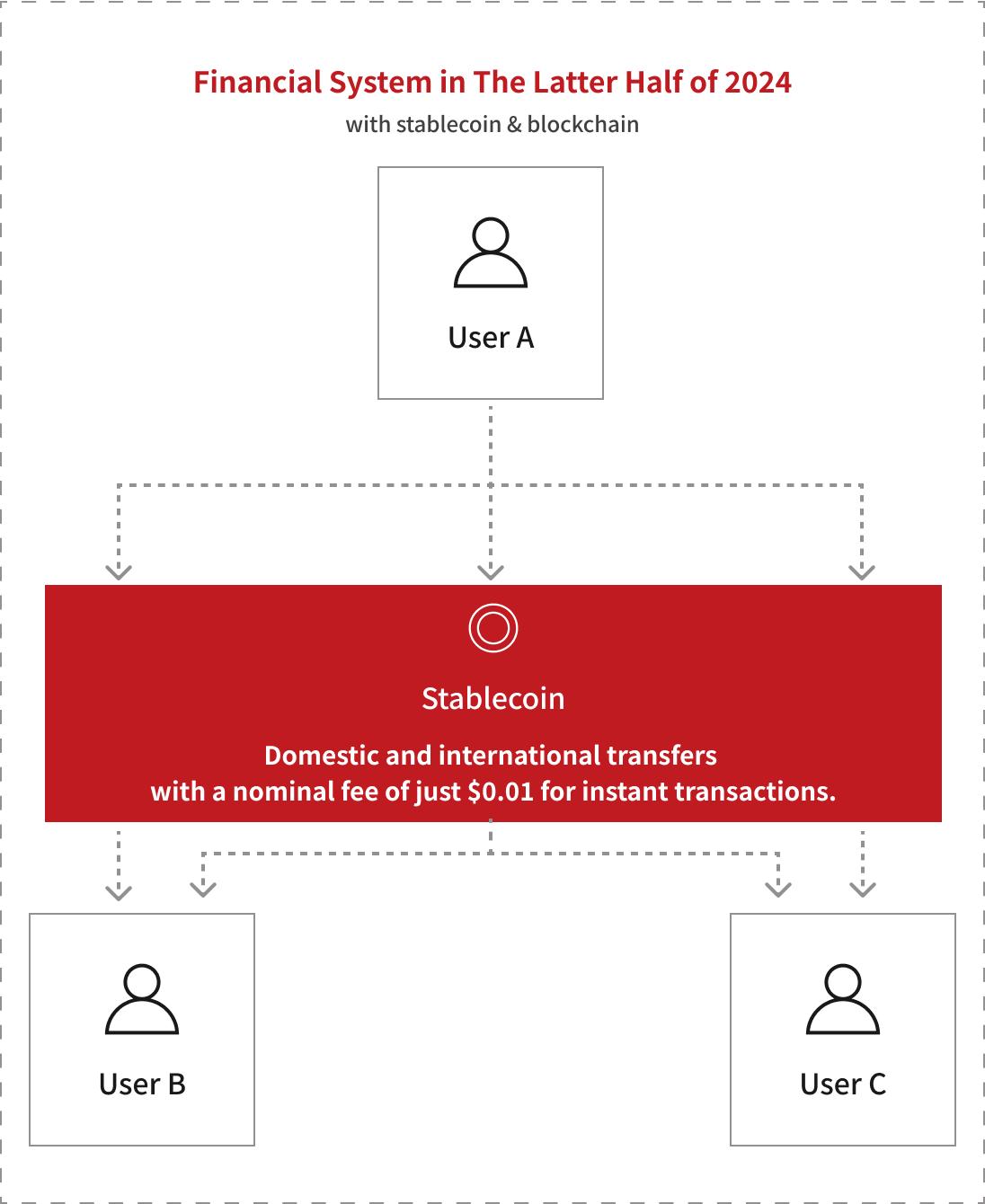

What is a Stablecoin

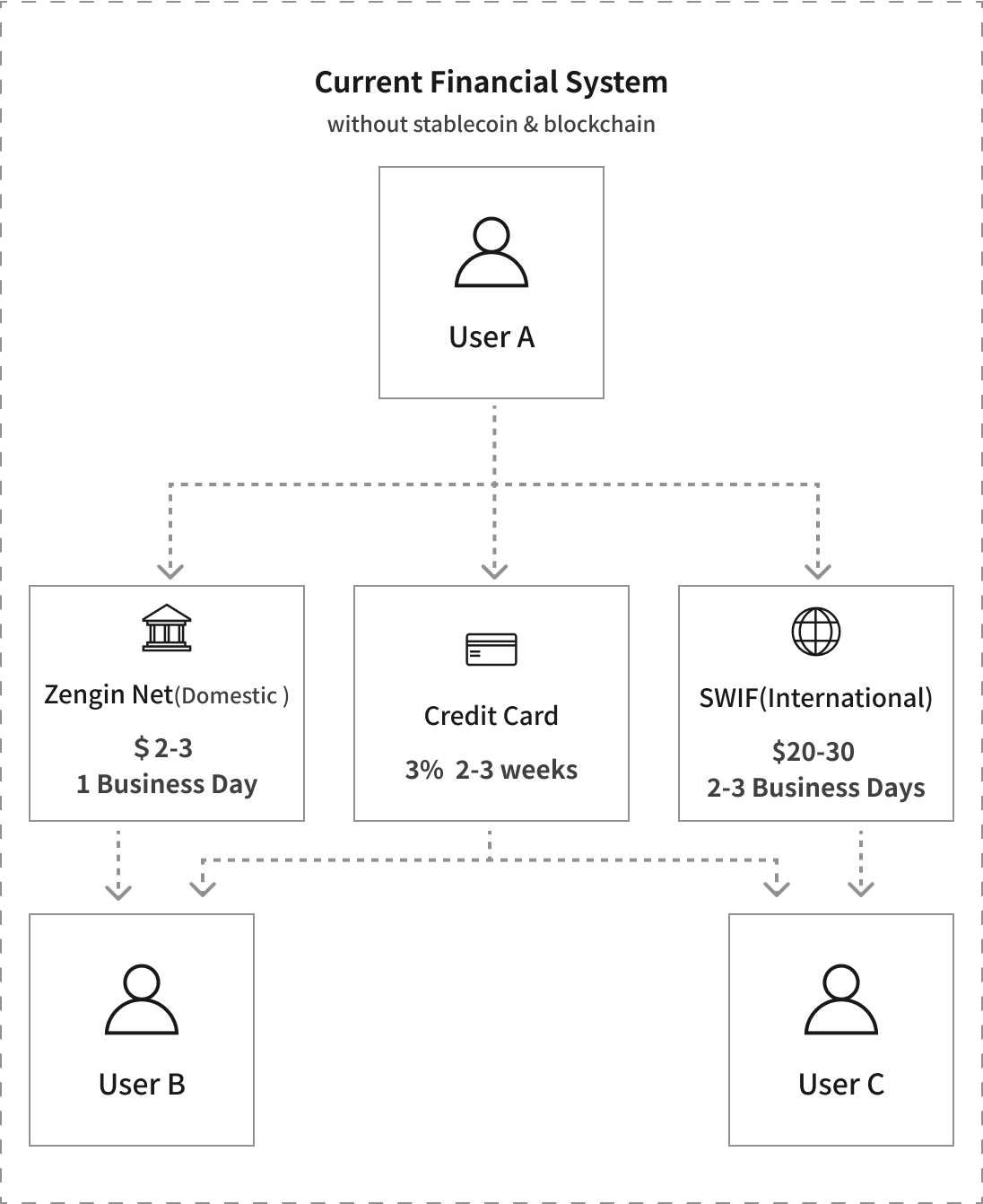

In the expanding digital economy, interest in RWA Tokens (short for Real World Assets, meaning the tokenization of real-world assets) is increasing. Targeting valuable real-world assets such as real estate, bonds, and gold, stablecoins are considered a representative example of RWA as they tokenize "legal currency." About 20 trillion yen of stablecoins linked to the US dollar have already been issued and circulated, and expectations for circulation in the Japanese market are also increasing.